Portsmouth Va Real Estate Assessments

Appeals & Notices Portsmouth, VA

Appeals & Notices - The valuation of a property may only be discussed with the property owner or a duly authorized agent for the owner. - In the case of a representative of the owner requesting an informal or formal review, an original signed Letter of Authorization or Power of Attorney, granted by the property owner, is required.

https://www.portsmouthva.gov/164/Notices-Appeals

2026 Hampton Roads property tax assessments explained

Notices for 2026 assessed values are scheduled to be mailed by April 1, 2026. Informal appeal deadline with the assessor: May 8, 2026. Formal ...

https://www.13newsnow.com/article/money/2026-property-tax-assessments-explained-what-homeowners-need-to-know/291-16c72d34-83ac-482f-be1c-b494a154af43an ordinance to provide taxpayers with real estate tax

... 2026, and real estate taxes will be levied and collected for the fiscal year based on that assessment; and. WHEREAS, assessments of real ...

https://www.portsmouthva.gov/DocumentCenter/View/16868/25-126h-OrdinanceCITY OF PORTSMOUTH, VA

NOTE: The proposed FY 2026 Operating Budget as submitted to the City. Council maintains the FY 2025 real property tax rate of $1.30 per $100 of.

https://www.portsmouthva.gov/DocumentCenter/View/16859/25-125-Public-hearingPortsmouth's $1 billion budget proposal lowers real estate ...

The fiscal 2026 budget proposes a 6-cent credit, bringing the effective rate from $1.30 per $100 of valuation to $1.24. Council enacted a 5-cent ...

https://www.yahoo.com/news/portsmouth-1-billion-budget-proposal-233200257.htmlTax Structure in Portsmouth Portsmouth Economic Development

The tax structure in Portsmouth is designed to support the development and services for the community - for both business and private citizens.

https://www.accessportsmouthva.com/info-hub/tax-structure/

Voices of Portsmouth, VA Tonight, council approved a budget that reflects our goals for our city Facebook

Tonight, council approved a budget that reflects our goals for our city. We funded: - Salary increases for city and school employees, supporting fair pay that will help us recruit and retsin staff as we grow. - Public safety initiatives, including recruiting and retaining police officers and developing a new public safety center.

https://www.facebook.com/groups/VOICESOFPORTSMOUTHVA/posts/9860516130677382/

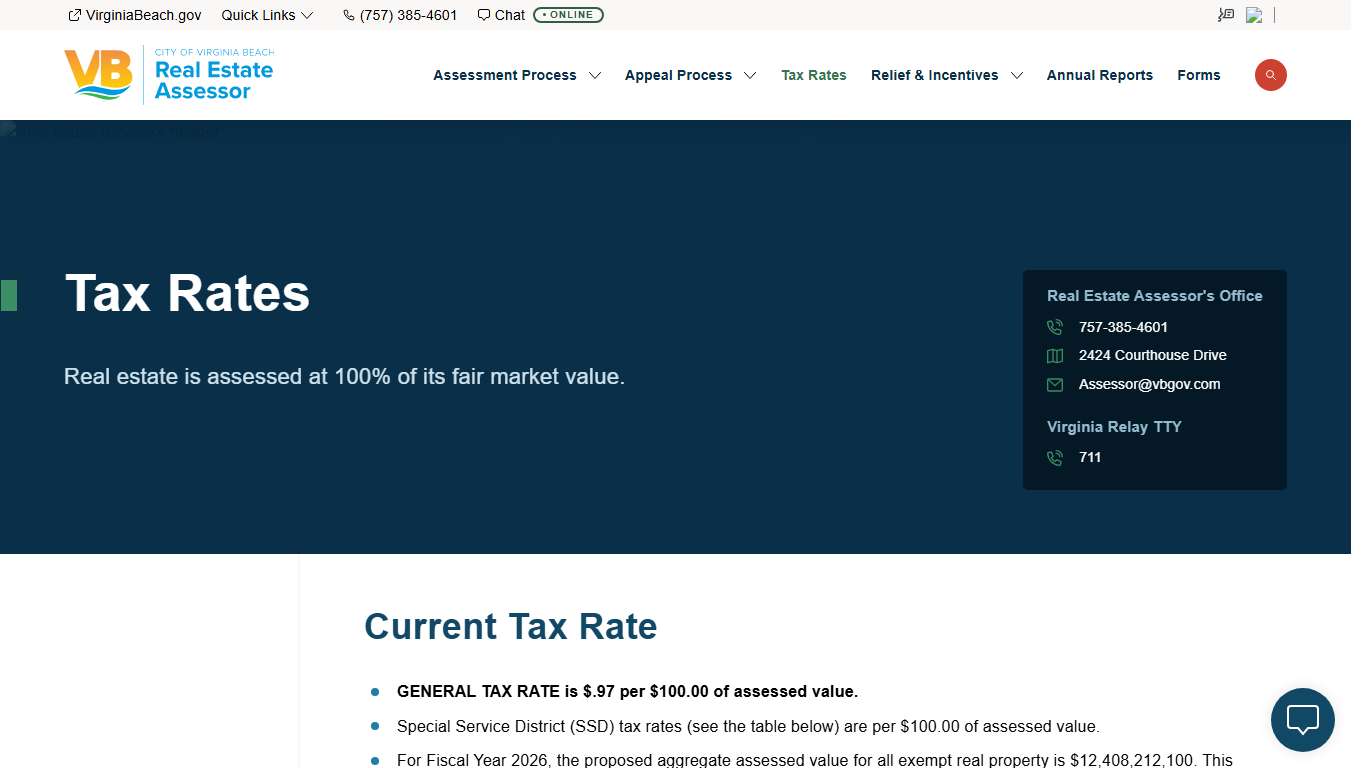

Tax Rates City of Virginia Beach

Current Tax Rate - GENERAL TAX RATE is $.97 per $100.00 of assessed value. SSD Rate SSD Sandbridge SSD Rate $.98 SSD Central Business District South SSD Rate $1.42 SSD Old Donation Creek SSD Rate $1.154 SSD Bayville Creek SSD Rate $1.442 SSD Shadowlawn SSD Rate $1.1294 SSD Chesopeian Colony SSD Rate $1.2613 SSD Harbour Point SSD Rate $1.09 SSD Gills Cove SSD Rate $1.13 SSD Hurds Cove SSD Rate...

https://assessor.virginiabeach.gov/tax-rates

Property Tax Collection City of Portsmouth

Property Tax Collection Important Dates - The 2025 1st Issue Property Tax Installment Bills were mailed and available on-line on December 24, 2025, and are due January 29, 2026 - The 2025 2nd Issue Property Tax Installment Bills will be mailed in early spring 2024, and will have a due date of June 1, 2026 - Interest of 8% starts accruing daily on any unpaid balance the day after the...

https://www.portsmouthnh.gov/tax/property-tax-collection

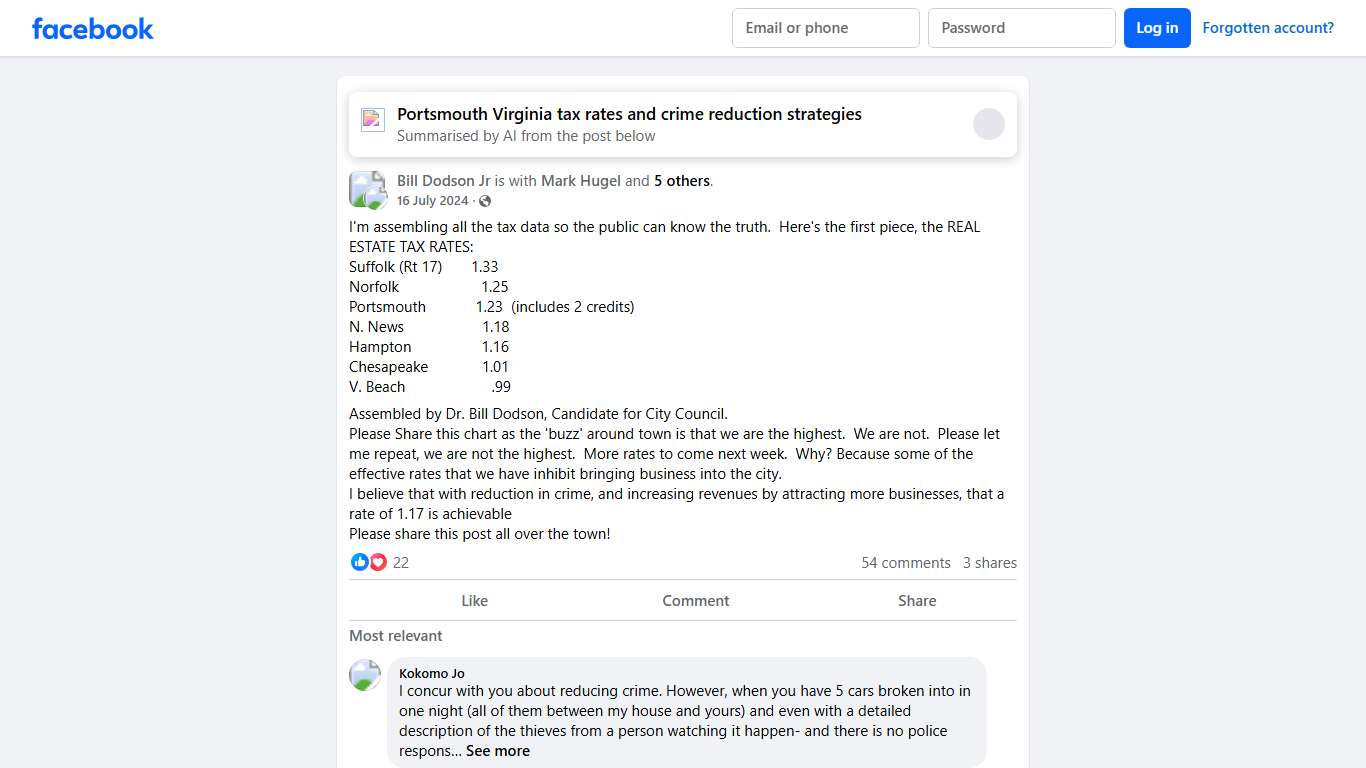

Voices of Portsmouth, VA I'm assembling all the tax data so the public can know the truth Facebook

I'm assembling all the tax data so the public can know the truth. Here's the first piece, the REAL ESTATE TAX RATES: Suffolk (Rt 17) 1.33 Norfolk 1.25 Portsmouth 1.23 (includes 2 credits) N. News 1.18 Hampton 1.16 Chesapeake 1.01 V.

https://www.facebook.com/groups/VOICESOFPORTSMOUTHVA/posts/7946909315371416/

Historic Rehabilitation Tax Credits Portsmouth Economic Development

Historic Rehabilitation Tax Exemptions City Council has approved an ordinance enacting a tax exemption for real estate that is substantially repaired, rehabilitated, or replaced. The tax exemption program encourages renovation and revitalization of aging structures. - Building must be 25 years old.

https://www.accessportsmouthva.com/business-resources/tax-exemption-programs-1/

Office of the Real Estate Assessor City of Norfolk, Virginia - Official Website

Office of the Real Estate Assessor The Office of the Real Estate Assessor annually assesses all real property located within the city limits in a fair, equitable and uniform manner. This office maintains timely and accurate land records information including parcel boundaries and ownership records.

https://www.norfolk.gov/291/Real-Estate-Assessor

Portsmouth, Portsmouth County, Virginia Property Taxes - Ownwell

Portsmouth, Portsmouth County, Virginia Property Taxes Median Portsmouth, VA effective property tax rate: 1.25%, significantly higher than the national median of 1.02%, but lower than the Virginia state median of 0.89%. Median Portsmouth, VA home value: $208,665 Median annual Portsmouth, VA tax bill: $2,610, $210 higher than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/virginia/portsmouth-county/portsmouth

2026 Portsmouth, Virginia Sales Tax Calculator & Rate – Avalara

Find the 2026 Portsmouth sales tax rate. Use our tax calculator to get sales tax rates by state, county, zip code, or address.

https://www.avalara.com/taxrates/en/state-rates/virginia/cities/portsmouth.html

Real Estate Assessor City of Virginia Beach

Reassessment Notices Are Mailed in March In accordance with Code of Virginia Title 58.1-3330, property owners will be sent a reassessment notice mailed by March 1 of each year. Upon request, hearings will be held to review your assessment from March to April 30 of each year.

https://assessor.virginiabeach.gov/